Price Waterhouse Coopers (PwC) has published a new report which says the the UK hotels market has reason to be cautiously upbeat, pointing to improving confidence in the sector, and a return to normal growth for London after the post-Olympic dip and the beginnings of a turnaround for the provinces after six years of decline.

Robert Milburn, UK Hotels Leader at PwC, says that of course things might change, but right now, in the first week of September things feel rosier for the UK economy than at any point over the past three years. He goes on to say that the services sector in particular is experiencing “a good run” and signs are that prospects for the hotels sector have “picked up” as well.

In PwC’s report, The right kind of growth – UK hotels forecast 2014, Robert assesses the situation regarding the hotel sector.

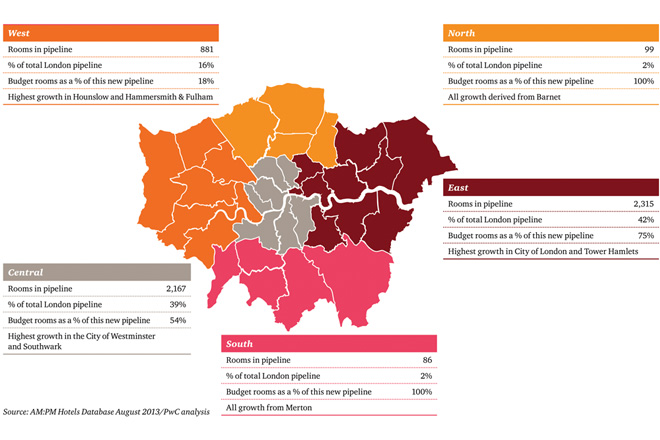

“For London, after a poor end to 2012 and a disappointing start to 2013, June saw both occupancy and ADR in positive territory for the first time since last October,” says Robert. “With occupancies at around 81-82%, London is technically full five and a half nights a week and looks likely to remain so despite the new supply that continues to open especially in the east.

“Rates may have tumbled from their 2012 Olympic-fuelled peak, but they look set to rise again in 2014 – even if they still have some way to go to overhaul 2012’s record year in real terms.

“The Provincial story has been a depressing one for the past three years and long term average real RevPAR (revenue per available room) has been in decline since 2007. But in 2013 and 2014 it looks as though this decline may have been halted. Occupancies have climbed back up slowly from 66% in 2009 and now stand at 71% – about as high as they get – having been on a rising trend since July last year.

“As we would expect, this improvement in occupancy is now feeding through into rates, which are beginning to harden and should continue to do so in 2014.

“With some tangible improvement now expected for the top line, the challenge for hotels is to keep a tight rein on costs and remain nimble in the face of continued high levels of new supply. Embracing the opportunities of the new digital wave will be one of the features of those who succeed – as will the good ‘old-fashioned’ concepts of location, service and attention to detail.

“With occupancies at around 81-82%, London is technically full five and a half nights a week”

“The backdrop for consumer and corporate travel volumes and expenditure remains challenging – most people remain worse off in real terms than they were five years ago. Cost reduction and operational efficiency remains a key concern for businesses.

“With no compelling reason for believing hotel demand is going to increase substantially or new hotel supply reduce significantly, we think the prospect is for modest RevPAR growth in 2014.

“Overall, UK occupancy rates should remain high in 2013 and 2014, at 74%. ADR (average daily rate) is expected to see a decline of 1.5% in 2013 but a 1.4% gain in 2014, taking the average price for a hotel room in the UK to £83. PwC expects no UK RevPAR growth this year but 2% growth in 2014, taking RevPAR to £61.75 – the highest, in nominal terms, for the past 13 years.

“Of course, stripping out inflation tells a different story with no records broken.

“Despite a volatile 2013 so far, with weak pricing, occupancy rates remain high and could end 2013 at 81%, creeping up a bit to 82% next year, as high as they were in 2010/11. We anticipate a 2.4% gain in London RevPAR in 2014 to take it to £112.80 – another record in nominal terms.

“Occupancy in the Provinces remains high by historical standards, at 71% (as high as back in 2007 and 2008). So far 2013 has seen only one month of occupancy decline (in January). We expect ADR to reach almost £60 in 2014 – still below the 2008 peak, even in nominal terms, but the best result since 2009. We expect 1.8% RevPAR growth in the Provinces in 2014, taking RevPAR to £42.44 – again the best result since 2008. In real terms, the Provinces have slipped a long way though.

“Historically there has been a close relationship between RevPAR and GDP growth so a sustained recovery in GDP should lead to increased levels of room demand and revenue growth for the following few years.

“Despite strong monthly (largely occupancy driven) RevPAR growth in the Provinces, UK city performance is very mixed with RevPAR growth in the prior year ranging from around -5% to +15%, according to data from STR Global. Some cities have seen consistent growth eg Aberdeen; others such as Liverpool, Edinburgh and Cardiff, have been up and down.

“These variations appear to be caused by a number of factors including the quantum of recent new supply, strength of local demand drivers and sometimes dire or exceptional prior year performance. London has also experienced volatility this year.

“It is far from clear, but the hope is that the early signs of stabilisation in performance that are being seen taking hold in the Provinces this year, continue into 2014. PwC does not expect a dramatic shift in relative regional economic fortunes over the next two years, faster rates of growth again tending to be experienced in the South and Midlands. However, all regions should follow the same broad upward trend and this will help support travel and hotel performance.

“While limited service and budget hotels are helping consumers who don’t want to pay the price of full service hotels, hoteliers in the mid-market especially are finding a more crowded and competitive environment”

“While the London market is up 0.2% overall in RevPAR terms in H1 2013, some segments have outperformed the market as a whole. Leading the field is the upscale or four star segment, which has performed particularly well, with 4.3% growth in RevPAR terms in the half year to June, and over 18% growth in June itself, according to data from STR Global.

“Upscale segments have seen lower supply growth in the first half of this year than some other segments including economy and luxury. The luxury segment saw ADR growth but occupancy declines while the economy segment saw quite the reverse. Of course London is not a homogenous market and location will also have impacted performance.

“Lapping the Olympics, particularly in Q3 this year has meant some tough comparisons for London hotels as well as some regional cities. Travel trends too may be obscured by comparisons with last year, when the Olympics attracted a very different type of sports fan and tourist to the usual profile. A return to some kind of ‘normal’ in 2014 will be welcomed.

“International inbound tourism to the UK continues to show steady growth and in H1 2013, there were 15.24m international visits to the UK – a 4% increase over the same period in 2012 and the best first half since 2008. But with weak economic growth in many of our main European tourism markets, it’s unlikely any inbound tourism records will be broken in 2013 or 2014.

“But, positively, business travel should pick up faster than leisure travel, where improving economic prospects will take longer to feed into discretionary income gains. Meetings and conferences are an important driver of demand and food and beverage spend for hotels, but again the outlook is far from fully recovered, nor is it likely to be in 2014.

“New brands, products and revamped existing products continue to open and a further 200 hotels and 19,500 rooms will open in the remainder of 2013 and 2014 alone. While this is below recent growth rates, London continues to see high rates of new supply. A high proportion of these new rooms will be in the budget segment – so it’s no wonder rates and independent operators are feeling the heat.

“Recent research from BDRC Continental shows budget operators, Premier Inn and Travelodge are now the top two brands in both the business and the leisure travel segments – the first time this has been recorded.

“With all markets changing like never before, hoteliers face a myriad of challenges. Mastery of the digital space is essential for future success but identifying the real opportunities is not always easy – Accor’s recent decision to offer free WiFi across its properties has put pressure on other operators. At the same time the cost of operating hotels continues to increase, squeezing margins across most areas of the business including food and drink, energy, technology, social media and business climate outlook.

“The UK economy grew by 0.3% in the first quarter of 2013, ending fears of a return to technical recession after the post-Olympics fall in GDP in the fourth quarter of 2012. Growth in the first quarter was driven entirely by services, with manufacturing and particularly construction still acting as a drag on the economy.

“We expect GDP growth to pick up gradually from 0.2% in 2012 to around 1.3% in 2013 and around 2.3% in 2014. Risks to growth are now more balanced, having previously been weighted to the downside. However significant risks remain, including instability in the Middle East and the eurozone fiscal environment.

“Despite the funding crisis, another 20,000 rooms and almost 200 hotels will open in 2013 and 2014, ie within the parameters of PwC’s current forecast, according to data from AM:PM Hotels Database. While the regions will see a lower rate of growth than in 2011 and 2012, it is in addition to the 18,000 rooms that opened in the UK last year.

“Over half of these new rooms will be budgets; a quarter will be four star and most will be branded. While limited service and budget hotels are helping consumers who don’t want to pay the price of full service hotels, hoteliers in the mid-market especially are finding a more crowded and competitive environment. New, modern, strongly branded properties, often technology friendly, are giving consumers what they value and will make the going harder for more ‘tired’ products, clearly in need of investment.”